We’ve probably all heard stories about people who invested in XYZ stock ten years ago and then forgot about them but those investments have been turned into worth millions of dollars today. Although the stories sound fantastic, this doesn’t mean that all the investment was successful and easy as it seems. Several businesses failed, and investing in them would have wiped away the funds. To look at it another way, the best results come from long-term operations in fundamentally good businesses. This is valid across all types of investments, including financial markets. So, if you are going to be interested in Bitcoin trading you might consider use a reputable trading site to help you out in your trading journey.

Investing and then forgetting about it for a long time might be a great strategy that has been followed by big investors for years, the success depends majorly on what type of fund you are holding. And this also necessitates much investigation as well as some good fortune.

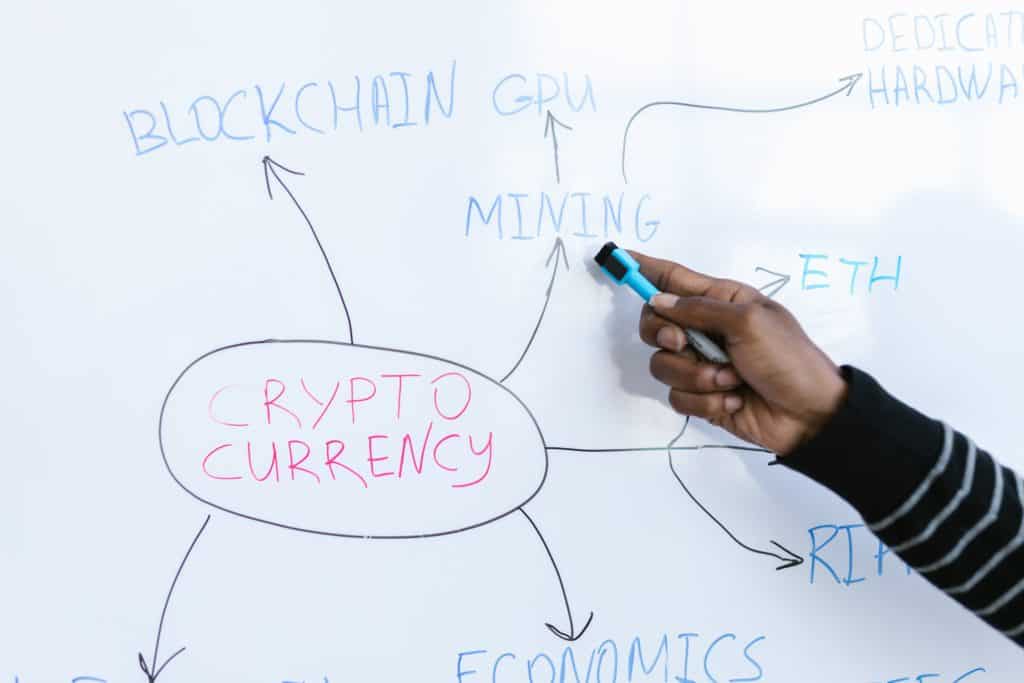

Know basics about investing and trading

Investing is the way of distributing assets in the financial market in order to make profits. Investing can be done in many ways. One can start a business utilizing the money in a hope that it would grow and bring profit on the capital amount. Or, one can purchase land and sell it later when the price of the particular land will increase. In the capital market investing means, buying assets for a long time and later selling them at an inflated price. The spread between the buying price and selling price is the earning. Investors are typically unconcerned about short-term price swings because of their long-term perspective.

Traders, on the contrary, strive to profit from market fluctuations. Trading is another form of investing but it is done for a short time. Here buying and selling is done more frequently. The returns are not as big as investing but the number of winning is more.

Bitcoin investing and trading

Investing and trading in the crypto market is not as easy as in the share market. In the case of the share market, there is an option for investing through mutual financial firms. The fund managers are experts to create returns with great strategies and they will serve the profit to you in exchange for a fee. But, in the crypto market, you have all the responsibility for profit or loss in an investment. You do it individually.

Stock, commodities, and trading, and also the Cryptocurrencies markets, all use margin trading. An investment broker provides the funds borrowed in a far more traditional environment. The money is often lent by the exchanges in exchange for a funding fee when it relates to cryptocurrencies.

Some tips for bitcoin investment

Some bitcoin investors suggest short-term trading due to bitcoin’s volatility whereas some suggest long-term investment. Whatever you do, you have to understand the market and be concerned about some factors.

- Initially, you must buy in multi-currency which means some altcoins along with bitcoin. If the other factors that are responsible for crypto’s price remain constant, you will get more income. When disposable income rises, one might think about increasing regular investments. It provides consistent capital growth and also a compounding impact.

- Self-improvement is necessary. It comes from studying the market, strategies, and practice little by little.

- Long-term wealth cannot be built by investing and forgetting about bitcoin investment. In the past years, investing in digital currencies would have yielded multifold returns. Remember that they are intrinsically powerful tokens. Investors must do extensive due diligence to find such gems, as there may be numerous that are still virtually obscure and undervalued. Dealing in the past years and forgetting about it would have resulted in a negative return. Participating in the trading platforms and forgetting about it would have yielded about a greater percentage of returns.

- Diversifying assets between asset classes and inside the same financial asset is essential.

Know the market cycles.

You’ve probably heard the expression “the market goes in cycles.” A loop is a trend. Higher time frame market cycles are usually more reliable than lower time frame market cycles. Certain asset classes may outperform others due to market cycles. Due to various market conditions, the same types of investments may outperform other kinds of assets in other sections within the same market cycle.

Conclusion

Remember, you invest for the long run because you want a good profit. But, only investing will not help. Rather, getting track of the market is important.